The New Credit Company

NOTE: United States citizenship and a valid United States Social Security Number are required.

Send us a request to start your New Credit Case from your email address of choice. This will be the email address we use for your New Credit Username(s), and the one we use for all communications.

For your greatest security, create a dedicated New Email Address & secure password.

We need your name and phone number. Let us know if your case is URGENT.

DO NOT include personal data (such as Social Security Number).

Ensure delivery/receipt of every case-related email we send. For help: Safe Senders List

You will receive an email with our New Credit Checklist to prepare for your case. Follow the instructions for your easiest possible credit program.

You will also receive an email inviting you to create a secure password for your online file storage folder through Citrix ShareFile (our security partner), as well as your starting compliance documents for safely signing online through Citrix RightSignature.

You are providing the personal data that we use to manage your credit, as well as the compliance documents required by state and/or federal consumer laws.

It may take 15 to 30 minutes to complete everything. We might call you for help with security information when we pull your credit reports.

The credit bureaus do not want you to succeed. For security reasons, they may reject our efforts to obtain each credit report. The better the information you provide during our intake process, the faster it will go. The bureaus (Experian, TransUnion & Equifax) often have wrong personal information, which may also slow us down.

However, it should only take you about a half hour (+/-) to complete your start and compliance documentation.

From there, we may have to call you a couple of times for brief help with personal history data to pass their security tests.

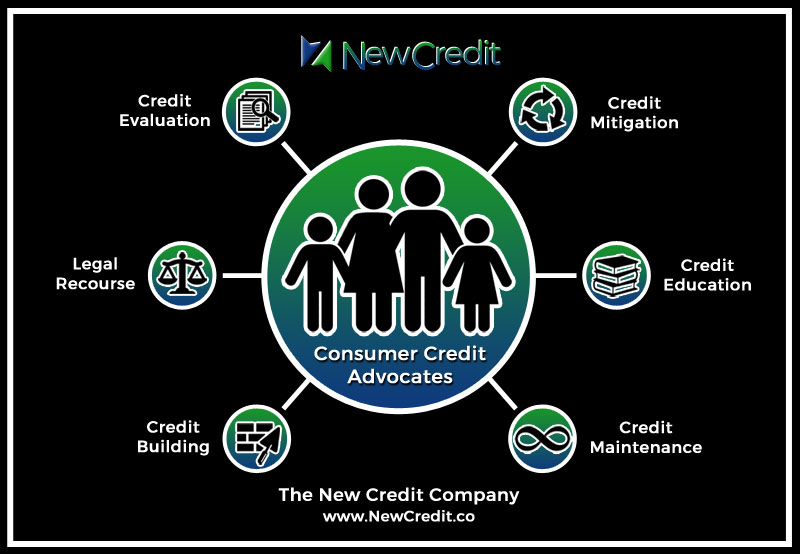

Once we have the three credit reports, we take over with a thorough evaluation of your credit status.

The credit industry works in 30 business day cycles. Federal Consumer Protection Laws protects your rights, and this schedule.

We begin with an evaluation and strategic plan. If we determine that one or more items in your credit reports are incorrect, outdated or otherwise require a dispute, we will manage the entire dispute process.

The vast majority of our clients can expect results by the end of the first and second dispute phases.

Those with the most negative credit status should have the most dramatic positive effect, though it will also take the longest to complete their credit services phase. That may be up to six months, or in rare cases, a year or longer.

If you have just been declined for a car loan or new home mortgage, time is critical. Our team is expert at credit-related crisis management.

We offer an urgent priority credit service, placing your case at the front of the line, and executing our maximum effort on each and every negative influence.

For the most immediate effect, some clients want the extra benefit of becoming an authorized user on the account of one of our clients with an excellent credit status.